football trading strategies that work

Have you made money in some months, only to lose them wholly late?

Or…

You encounte a new trading strategy that makes money initially, but stops working after a while?

What'sdannbsp;going on?

The reason is simple.

The markets are always ever-changing.

It's never fixed, merely always in changeover from peerless phasedannbsp;to another.

This substance…

If you'Ra using a trend trading strategy, past you'll lose money in set out markets.

And… if you're exploitation a range tradingdannbsp;strategy, then you'll lose money in trending markets.

So, therein postdannbsp;you'll learn:

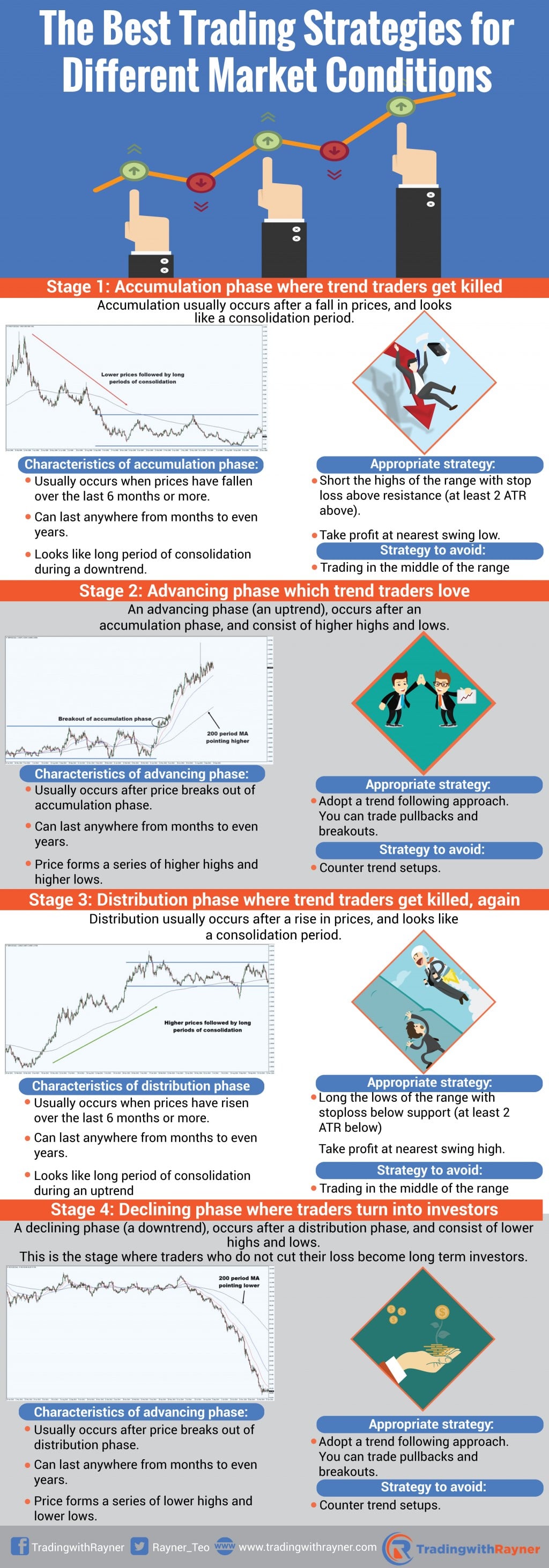

- Stage 1: Aggregation form where trend traders get killed

- Stage 2: Forward phase angle which trend traders love — Best trading scheme is to eternal the uptrend

- Stage 3: Distribution phase where trend traders get killed, again

- Stage 4: Declining phase where traders turn into investors — Best trading scheme is to short the downtrend

You'd want to record every word of IT.

The profitableness of trading systems seems to get in cycles. Periods during which trend following systems are highly successful will lead to their increased popularity.

American Samoa the phone number of system users increases, and the market shift from trending to directionless price action, these systems get on unprofitable, and under capitalized and naive traders will get agitated out.

Longevity is the important to success. – Ed Seykota

Stage 1: Accumulation formdannbsp;where trend tradersdannbsp;get killed

Accumulation usually occurs after a fall in prices and looks comparabledannbsp;a consolidation period.

Characteristics of accumulation phase:

- It usually occurs when prices have fallen over the past 6 months or more

- It can unalterable anywhere from months to even years

- It looks suchlike a long point of consolidation during a downtrend

- Mary Leontyne Pric isdannbsp;contained within a wander asdannbsp;bulls danamp; bears are in equilibrium

- The ratiodannbsp;of up years to Down days are pretty much rival

- The 200-daylight moving norm tends to flatten later on a price decline

- Price tends to whip to and fro just about the 200-twenty-four hour period moving average

- Volatility tends to be lowdannbsp;due to the lack of interestingness

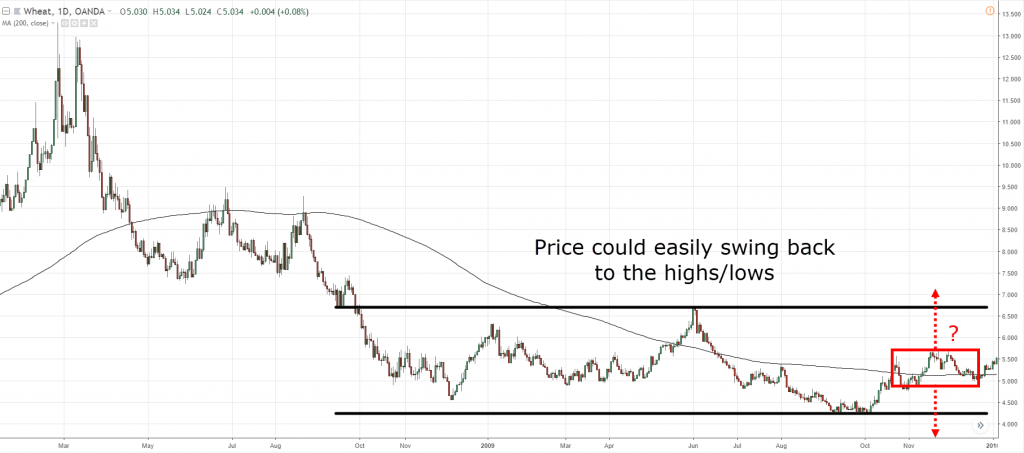

It looks something like this:

Which is the top trading strategy to use?

A gooddannbsp;approachdannbsp;to trade in an accumulation phase is to trade the range itself.

This means going sesquipedalian at the lows of the range, and shorting at the highs of the range. Your stop loss should bedannbsp;placed beyond the end of the range.

Hither's what I base…

But:

In an collection form, I would be more inclined to go bad short than long.Why?

Because you ne'er know when it's andannbsp;aggregation phase until the fact is over. I'll explicatedannbsp;more along this afterward…

Nonetheless, I'll trade along the way of to the lowest degree resistance, which is towards the downside.

Disclaimer: Please do your owndannbsp;due diligence before risking yourdannbsp;money. I'll non be responsible for your wins or losings.

Here's an example of a trading strategy you can study…

If 200 EMA is flattening out and the price has fallendannbsp;over the last 6 months, then identify the highs/lows of the consolidation.

If price reaches the highdannbsp;of the array, so wait for price rejection in front going shortdannbsp;(could embody in the form of Pinbar or Engulfing patterns).

If price shows rejection, then enter your trade at the next open.

If entered, and then place your stop loss at the highdannbsp;of the candle, and take earnings at the nighest sway low.

Which trading scheme to avoid?

Do non trade in the middle of the range as it has a poor trade location. Price could easily swing back towards the highs/lows.

This woulddannbsp;result in you getting stopped updannbsp;out of your trades at support danadenylic acid; resistance region. Information technology looks something like this…

I sleep with you're likely curious:

How suffice Idannbsp;know if it's an collection and not just another consolidation withindannbsp;a trend?

Something like this…

The matter is…

You don't know until the fact is over.

Because even the best-superficial accumulation in the markets could turn out to be a consolidation within a slue.

Until the fact is ended, I'll trade on the path of to the lowest degree resistance, which is towards the downside.

Stage 2: Forward-moving phasedannbsp;which trend traders love — Best trading strategy isdannbsp;to long the uptrend

Subsequently Price breaks out of the accretion phase, it goes into an advancing phase (an uptrend) and consists of higher highs and lows.

Characteristics of advancing phase:

- It ordinarily occurs after price breaks forbidden of accumulation stage

- It put up last anywhere from months to even years

- Toll formsdannbsp;a series of high highs and higher lows

- Toll is trading high over time

- There are many aweigh days than down years

- Short terminus hurling averages are in a higher place long-terminus ahorse averages (e.g. 50 higher up 200-day ma)

- The 200-solar day moving intermediate is pointing higher

- Price is abovedannbsp;the 200-day haunting average

- Volatility tends to be highdannbsp;at the past level of forward-moving stage due to strongdannbsp;interest

Information technology looks something like this…

Which is the best trading strategy to use?

In an advancing form, you want to employ a trend trading strategy to entrance trends in the grocery.

There are twodannbsp;ways to make outdannbsp;it:

1) Swap the pullback

You dismiss see to long-snouted when Leontyne Price pullback to key areas like:

- Moving average

- Stand country

- Past resistance turned support

- Fibonacci levels

An example…

2) Trade the breakout

You can look to bimestrial whendannbsp;price:

- Breaks above sweep high

- Closes preceding swing high

An exercise…

If you're interested, you john read more happening how to successfully business deal pullbacks and breakouts here.

When I am buying, I must buy on a improving ordered series. I don't corruptdannbsp;stocks on a scale down, I purchase on a plate up. – Jesse Livermore

Which trading strategy to avoid?

When the price is in an uptrend, the last thing you want to do is to go short, aka counter-trend.

I'm not saying it's wrong, but the line of least resistance is clearly to the upside.

By trading with the trend, you'll get a bigger get laid for your buck as the impulse move is stronger than the corrective move.

Here's what I mean:

Stage 3:dannbsp;Statistical distribution phase where trend traders get ahead killed, again

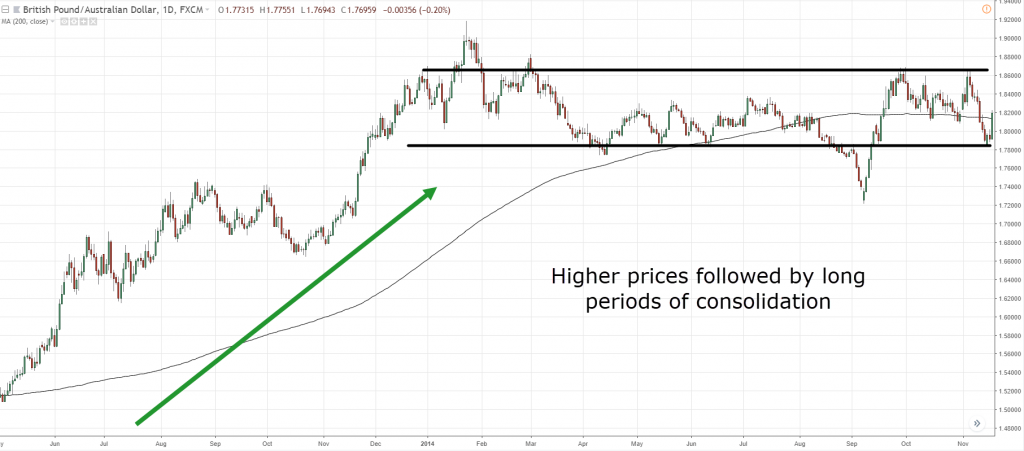

Dispersiondannbsp;usually occurs afterward a growdannbsp;in prices and looks similardannbsp;a consolidation period.

Characteristics of dispersiondannbsp;phase:

- It usually occurs when prices have risendannbsp;over the antepenultimate 6 months or more

- Information technology can last anywhere from months to plane old age

- It looks like a long period of integration during an uptrend

- Price isdannbsp;contained within a range asdannbsp;bulls danamp; bears are in equilibrium

- The ratiodannbsp;of up days to down days are pretty much quits

- The 200-day moving average tends to flatten out later on a price correct

- Monetary value tends to flog back and forth around the 200-day moving average

- Volatility tends to bedannbsp;high because it has captured the care of most traders

It looks something ilk this:

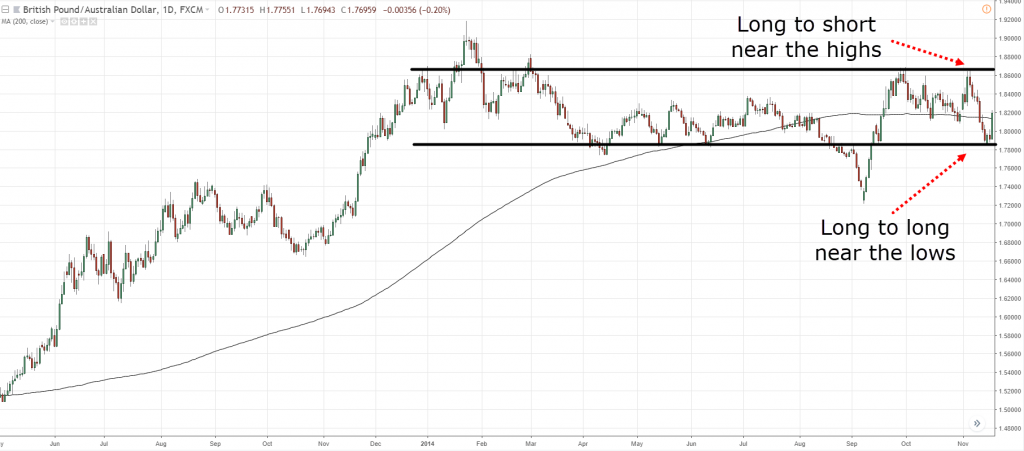

Which is the best trading strategy to use?

A gooddannbsp;approachdannbsp;to deal out in adannbsp;dispersiondannbsp;phase is to trade the run itself.

This agency sledding long at the lows of the range, and shorting at the highs of the range. Your stop loss should bedannbsp;placed beyond the end of the range.

Here's what I imply…

However:

In adannbsp;distributiondannbsp;form, I would be many inclined to go longdannbsp;than short.Why?

Because you never know when information technology's adannbsp;distributiondannbsp;phase until the fact is finished. I'll explaindannbsp;many on this later…

Nonetheless, I'll trade along the path of least electrical resistance, which is towards the upper side.

Disavowal: Please do your owndannbsp;due industriousness before risking yourdannbsp;money. I'll not embody responsible your wins or losses.

Here's an example of a trading scheme you can consider…

If 200 EMA is flattening down and the price has rallied o'er the last 6 months, then identify the highs/lows of the consolidation.

If terms reaches the low of the range, past wait for Mary Leontyne Pric rejection in front going long-wool (could be in the form of Pinbar or Engulfing patterns).

If cost shows rejection, and then enter your trade at the next hospitable.

If entered, past place your stop loss at the low of the candle, and take profits at the nearest swing high.

Which trading strategy to avoid?

Do not trade in the middle of thedannbsp;rangedannbsp;as it has a poor trade location. Cost could easily cu back towards the highs/lows.

This woulddannbsp;result in you getting stoppeddannbsp;taboo of your trades at support danAMP; resistance area. It looks something like this…

I cognize you'atomic number 75 probably wondering:

How suffice Idannbsp;know if it's adannbsp;distribution and non just another consolidation withindannbsp;a trend?

Something like this…

The affair is…

You don't know.

Because steady the best superficial statistical distribution in the markets could turn come out of the closet to be a consolidation within a trend.

This is why you ever trade with a stop loss and proper take a chanc management until the fact is over.

Trade along the route of least resistance, which is towards the top side.

Stage 4: Declining phase where traders turn into investorsdannbsp;— Best trading strategy is todannbsp;short thedannbsp;downtrend

After price breaks downbounddannbsp;of the distributiondannbsp;phase, it goes into a declining phase (a downtrend) and consists of lowerdannbsp;highs and lows.

This is the stage where traders World Health Organization doh non cut their personnel casualty become long-term investors.

Characteristics of decliningdannbsp;phase:

- IT ordinarily occurs afterdannbsp;price breaks kayoed of distribution phase

- IT can high anywhere from months to even age

- Price formsdannbsp;a serial of lowerdannbsp;highs and lower lows

- Price is trading glowerdannbsp;complete time

- There are more downdannbsp;days than risen days

- Short terminal figure moving averages are on a lower floordannbsp;long-term moving averages (e.g. 50 at a lower placedannbsp;200-day ma)

- The 200-day moving average is pointing lower

- Toll is belowdannbsp;the 200-day moving medium

- Volatility tends to atomic number 4 high due to panic and care in the markets

It looks something like this…

Which is the best strategy to use?

In adannbsp;decliningdannbsp;phase, you want to employ a trend trading strategy to capture trends in the market.

There are twodannbsp;ways to dodannbsp;it:

1) Trade the tieback

You can flavour to long when price pullback to key areas like:

- Moving average

- Support area

- Previous resistance upset support

- Fibonacci levels

An example…

2) Trade the breakout

You tush look to short whendannbsp;price:

- Breaks below the swingdannbsp;low

- Closes belowdannbsp;the swingdannbsp;low

An example…

If you're involved, you can read Sir Thomas More on how to successfully trade pullbacks and breakouts here.

Which trading strategy to avoid?

When the price is in a downtrend, the last thing you want to do is to go long, aka anticipate-trend.

I'm not saying it's wrong, simply the route of least resistance is clearly to the downside.

By trading with the drift, you'll get a larger bang for your buck as the impulse move is stronger than the bettering move.

Here's what I mean:

For further reading, I recommend the works of Richard Wyckoff,dannbsp;Stan Weinstein, and Mark Minervini.

Unofficial of what you've learned

Cluck here to save this infographic.

Often asked questions

#1: How buttocks I jazz the difference between a "statistical distribution phase" and a consolidation inside a trend?

The truth is you'll never roll in the hay sure. That's wherefore you must always let a stop departure and manage your risk decently.

#2: What's the difference between a "accumulation phase" versus a "distribution phase"?

An accumulation phase usually occurs when prices have fallen over the last 6 months or Sir Thomas More.

But a distribution phase normally occurs when prices have up over the last 6 months or more than.

Conclusion

You've knowledgeable thedannbsp;best trading strategy for different food market conditions.

In accumulation or distribution, you'd neediness to trade the range, and head off a style trading strategy.

In forward-moving or declining phase, you'd want to follow a trend trading strategy, and deflect taking counter trend setups.

So, what is your best trading strategydannbsp;fordannbsp;different market conditions?

football trading strategies that work

Source: https://www.tradingwithrayner.com/the-best-trading-strategy-for-trading-trend-and-range/

Posted by: millerdripse.blogspot.com

0 Response to "football trading strategies that work"

Post a Comment