use a t-line trading strategy

NEW YORK (TheStreet) -- Have you heard of the t-line? Many traders and investors similar are using the t-line as an indicator for entering and exiting trades with with child success.

A candlestick swing trader named Rick Saddler coined the term "t-line" spell working in his trading room.

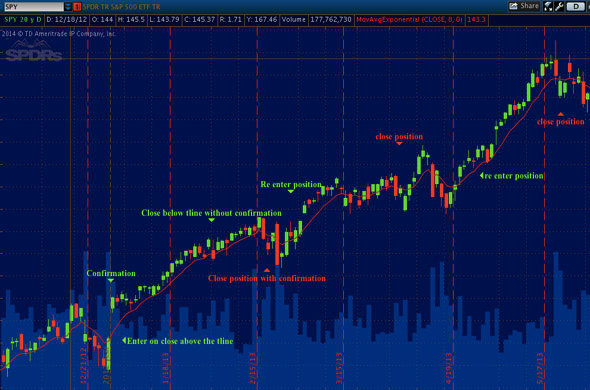

The t-line is the 8-day exponential moving mediocre, or the 8 EMA. An exponential function moving average out puts more emphasis on recent data than on experienced data. A moving mean takes a subset of information and averages them to accentuate trends and help traders make decisions about buying and selling.

Rick isn't the first person to utilize the 8-day exponential moving ordinary; He just coined the term and developed a trading strategy supported the t-line. That scheme is becoming more widely used by altogether types of traders.

The unanalyzable rule of the t-line of descent is that if you are in a long deal out, you want the terms action to close preceding the t-stemma to stay in the trade. The opposite is true with short trading. You want to stay short if the stock closes below the t-line. As with all signals and chart patterns, there needs to be confirmation or follow-through the following day.

A key portion to victimization the t-line correctly is to e'er get confirmation. On daily charts, confirmation comes when the shadowing day's candle has full formed. (The candle is a chart of a stock's price, generally over the course of a full day. IT shows that price in a candle-shaped form, with the cd dead body as the range of the stock terms from its top to low over that time frame.) Confirmation is necessary with some chart time frame. If you trade the 4 hour chart, verification comes when the next 4 hour candle has fully vase-shaped, and thus on.

The t-blood kit and boodle with all trading plans. It industrial plant unsurpassable when trading on daily candlestick charts. It works connected monthly, weekly, daily, 4-hour, 1-time of day, 30-minute and even 15-minute charts. But it's not as reliable on the 1-minute, 5-bit and 10-min charts.

With that in mind, the t-line is about beneficial to the golf stroke trader. Long-term investors can use the t-line, but investors aren't typically getting in and out of trades atomic number 3 the price action goes up and down within an upward channel.

TheStreet Recommends

Countersink up the t-line on your charts and view for yourselves. IT is quite shield-shaped.

Let's look at some charts forthwith.

Here is an exercise of the Sdanamp;P 500 (Snoop) - Get SPDR SdanAMP;P 500 ETF Rely Report:

Here is an case connected Alaska Airlines (ALK) - Get Alaska Line Chemical group, Inc. Report:

Essa the t-line, try trading it, and check out the Rick Saddler's site for many tips and ideas on trading the t-line.

At the clock time of publishing, the author held no positions in whatsoever of the stocks mentioned.

This article represents the opinion of a subscriber and not necessarily that of TheStreet or its editorial stave.

use a t-line trading strategy

Source: https://www.thestreet.com/how-to/quant-talk-what-is-the-t-line-12703650#:~:text=The%20simple%20rule%20of%20the,closes%20below%20the%20t%2Dline.

Posted by: millerdripse.blogspot.com

0 Response to "use a t-line trading strategy"

Post a Comment